By Steven Thomas – Reports on Housing

The Orange County housing market is not changing that much. What you see is what you will get for the rest of the year. Cruise Control: The inventory is increasing, demand is flat, and foreclosures and short sales are almost nonexistent.

This year’s housing market is remarkably different than the prior two extremely hot years. The market is still really strong; it’s just not out of control crazy like before. 2012 and 2013 were marked by very low inventories and not enough homes to go around, so multiple bids and rampant appreciation were the norm. Home values were rocketing upward, almost too fast. The appreciation that occurred in those two years should have been spread over five years. It just happened overnight, way too fast.

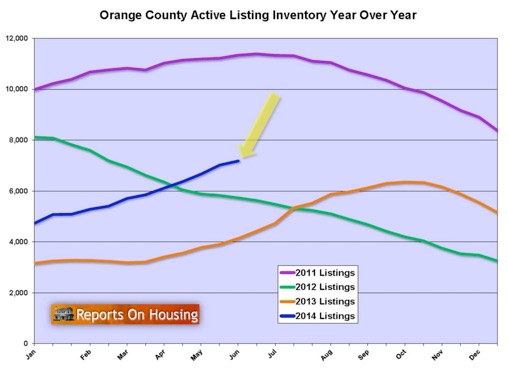

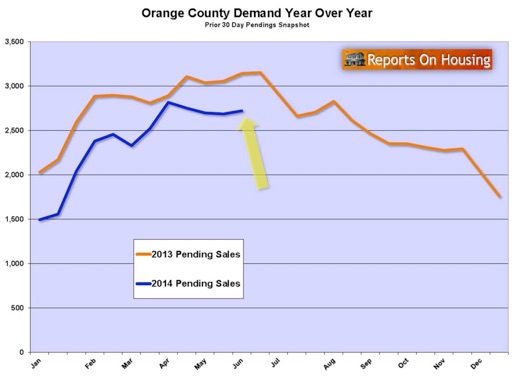

Flash forward to today, and the active inventory has been on the rise the entire year. We have gone from an inventory of 4,733 homes at the start of the year to 7,182 today, a 52% increase. Meanwhile demand has not changed much this spring. In the past month, demand has only increased by 24 homes and totals 2,723, far fewer than last year when it posted 3,144 pending sales. And, short sales and foreclosures only account for 7% of all closed sales thus far in 2014. For those buyers holding out for a foreclosure, they made up only 2% of closed sales. The chances of securing a foreclosure, if that’s what your heart desires, are extremely slim. You can also expect a lot of competition since everybody is sniffing around for a “deal.”

With a rising inventory and flat demand, the expected market time has been rising and appreciation has slowed to a crawl. As a matter of fact, appreciation is starting to bump up against a ceiling. Because values have increased substantially, they are at a point where they cannot continue to increase without taking a giant bite out of home affordability. Buyers do not want to be left holding the bag like they did right before the Great Recession, so they are not allowing the bidding up of prices to continue. They have traded in their exuberant zeal to pay whatever price to obtain a home for a methodical approach to paying the Fair Market Value of a home. That’s because home values were a deal over the past couple of years and now they are priced where they need to be. They are no longer a “deal,” but they are also not overinflated either.

Values are bumping along a ceiling, not really changing much at all from one month to the next. The average sales price for May was $721,000 this year versus $692,000 last year, only a 4% difference and that is year over year. Month to month it is almost negligible.

So, if you are a seller, waiting for values to rise to your overpriced level, or if you are a homeowner waiting for values to increase before you place your home on the market, you are going to be waiting a very long time. Today’s market is going to be tomorrow’s market for some time into the future. What you see is what you get. The Orange County housing market really does feel like it’s on cruise control with no major changes recently nor into the future. Sellers need to get real and price their homes according to the most recent comparable sales. If you are on the market for a while with no offers to date, the market is speaking to you loud and clear, “You are overpriced.”

For buyers, if you are waiting to purchase because you think that home values are going to drop down the road, think again. That is not going to happen anytime soon. If that’s the message that you are reading into this report, you are receiving the wrong message. Memo to all buyers: it is still a seller’s market. Sellers are in control. If they price their home at the Fair Market Value, they will procure plenty of activity and will sell quickly. Sellers are not able to randomly price their homes, but they are still in the driver’s seat. The expected market time would have to rise to 6 months for it to transform into a buyer’s market. Currently, the expected market time is 2.64 months, or 79 days. Not even close to the 180 days needed to tip the scales to a buyer’s market.

It is as if the housing market is on cruise control. The inventory is rising and will continue to through the end of the summer. Demand is not changing much and that will continue through the end of summer as well. Distressed properties, both foreclosures and short sales, will take a backseat in the housing market for the long term. The expected market time will continue to slowly rise, but will not slip into buyer’s market territory anytime soon. This is the Orange County housing market. To expect anything different right now or on the horizon is irrational.

Active Inventory: The active inventory increased by 8% in the past month.

The active listing inventory added an additional 162 homes in the past two weeks and now totals 7,182, levels not seen since February 2012, 28 months ago. This year, the inventory has grown unabated and is poised to continue to increase through the end August.

After starting the year at 4,733, the inventory has climbed 2,449 additional homes, a 52% increase. Keep in mind, in order for the active inventory to grow, more home need to be placed on the market than are coming off as pending sales. Last year at this time there were 4,133 homes on the market, 3,049 fewer than today.

Demand: Demand remained almost unchanged in the past month.

Demand, the number of new pending sales over the past month, increased by 36 and now totals 2,723. We are about to leave behind the Spring Market and enter into the Summer Market where demand will continue the change of not changing much at all. It will drop a bit in July, but will increase a little in August, one last “hoorah” before downgrading a bit in the Autumn market when the kids go back to school.

Distressed Breakdown: Since the end of April, the distressed inventory has only increase by 4 homes.The distressed inventory, foreclosures and short sales combined, decreased by 6 homes and now totals 253. In 2014, the distressed inventory has not changed much, starting the year at 271. The long term trend is for it to remain at a very low level. Last month, they represented only 6% of all closed sales.

In the past two weeks, the number of active foreclosures decreased by 14 homes and now totals 60. There are 144 zip codes in Orange County, so there simply are not enough foreclosures to go around. Less than 1% of the active inventory is a foreclosure. The expected market time for foreclosures is only 31 days and is currently the hottest segment of the housing market. The short sale inventory increased by 8 homes in the past two weeks and now totals 193. The expected market time is 39 days. Short sales represent less than 3% of the total active inventory.

In Huntington Beach the average list price is $951,000.00 and currently has 451 available listings.