Now that the Federal Reserve has ended its “tapering” and no longer is funding the secondary market, they are now looking on the horizon to increase the Federal Fund Rate. As that rate increases, long term interest rates eventually rise. Long term rates are what consumers use to purchase homes.

For now, the Fed is not going to touch the Federal Fund Rate. They are looking for specific signs in the overall economy: inflation and unemployment. Inflation has been flat and comfortably below their 2% target. Unemployment, on the other hand, has been steadily and surprisingly dropping and is inching closer to their target. As employment improves, the economy could overheat and the threat of inflation increases. 2014 is looking like the biggest gain in employment in 15 years. If the trend continues, we could see an increase in the Federal Fund Rate sometime next year. It is currently at just about ZERO, so there is only one direction it can go, UP.

The bottom line remains, as the economy improves, interest rates will rise. Eventually, that will occur and locking in on today’s historically low interest rates is an incredibly smart decision for today’s buyer. In five years from now when today’s buyers look back at their purchase in 2014 and 2015, they will see their decision to buy a home as a genius move. Rates will definitely be a lot higher then.

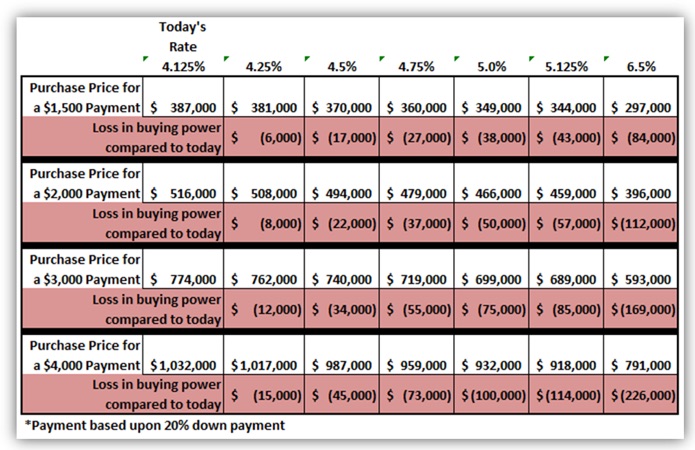

There is a wonderful way to illustrate why purchasing today at the current ultra-low rates is a “genius” move. As interest rates rise, affordability diminishes. The higher the increase, the more it impacts how much a buyer can afford. For example, if a buyer is looking for their mortgage payment to be around $2,000, based upon today’s 4.125% rate, a buyer can afford a $516,000 home with 20% down. At 4.5%, close to where rates were back in January, a buyer would only be able to afford a $494,000 home, or $22,000 less than today. At 5%, it would be $50,000 less. Prior to the downturn, interest rates were at 6.5%, which would be $112,000 less, or a $396,000 home.

The difference is even more staggering in the higher ranges.

Buyers looking at a $3,000 per month payment can afford a $774,000 home today versus a $719,000 home if rates increase to only 4.75%. And, buyers looking at a $4,000 month payment can afford a $1,032,000 home today compared to $959,000 with an increase to 4.75%.

Since most of the housing in coastal Orang County is in the higher price ranges (well over $775,000), one can easily understand why it is better for a buyer or seller of these property to buy while the rates are down. For buyers – the payments will be lower. For Sellers – there will be more buyers willing and able to pay top dollar for a coastal Orange County home. So, if you have had thoughts about buying or selling a home, it is probably a good idea to accelerate those plans.

Historically speaking, today’s interest rates are astonishingly low.

They were at 6.5% prior to the downturn, 8% back in 2000, 10% back in 1990, and a staggering 18% in 1981. These levels are not mentioned to scare buyers into purchasing today, because rates are not about to skyrocket overnight. Instead, buyers & sellers should look at the incredible opportunity that is available today.

The smart bet is to pull the trigger now while buyers can afford to purchase more of a home.

Buyers who wait until sometime down the road are looking at a highly likely scenario of higher interest rates and a much smaller purchase price… Sellers who wait might end up facing a much softer market than today, and wait for a buyer much longer than they would like.