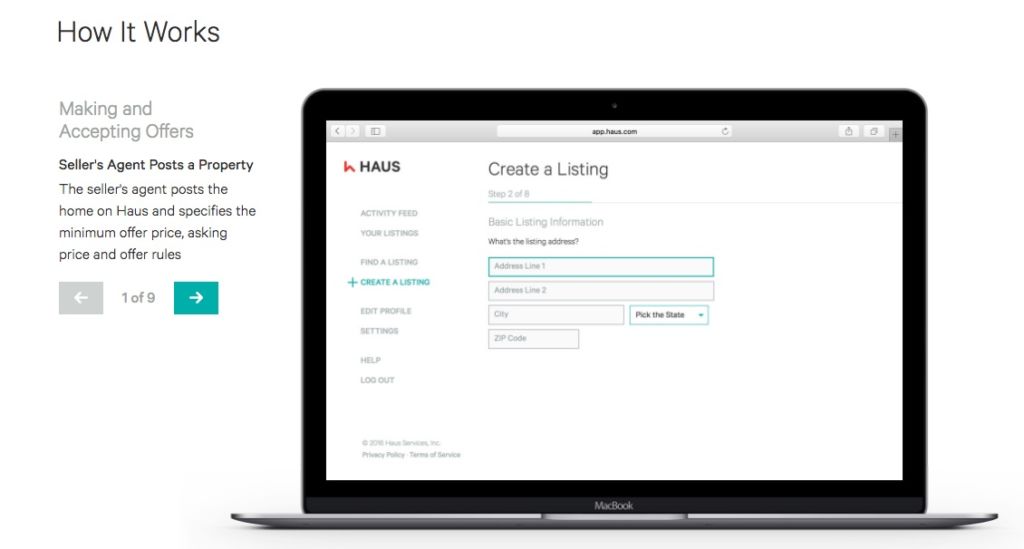

One of the pioneers of UBER is now trying to break into the Real Estate space and “shake things up”. Garrett Camp, co-founder of UBER and CEO of Expa Studios, released a new digital platform called HAUS which digitizes the offer submission and acceptance process. Camp says his new company isn’t trying to compete with the Zillows of the world in the crowded space of online home search.

Camp’s intention for HAUS is to digitize the offer submission and acceptance process. As reported by TechCrunch, the platform allows, “sellers [to] put their listing on the platform, where buyers and their agents can both post their offers, amend them, and see an anonymized version of other offers that have been made on the property.”

Camp’s intention for HAUS is to digitize the offer submission and acceptance process. As reported by TechCrunch, the platform allows, “sellers [to] put their listing on the platform, where buyers and their agents can both post their offers, amend them, and see an anonymized version of other offers that have been made on the property.”

However, people have been trying to do this sort of thing for years. Tons of websites and apps that are geared towards the “for sale by owner” (or as I like to call it DIYS-do it yourself seller) have been trying to accomplish this same feat for quite some time. Zillow also tried to make a run at this a few years back, and people were claiming 10 years ago that the Real Estate Agent will be headed for extension in no time. Those predictions have not panned out and Realtors are bigger and stronger than ever. The problem is (in California anyways) the purchase agreement is so legally loaded most DIY seller end up in litigation.

A broker once told me that 87% of sellers who don’t use an agent end up in litigation. Ouch!

If you’re selling a home that is a million dollars plus and get sued because you forget to disclose something so basic, it will cost you dearly. You are risking a million(s) to save a few grand. But is this all talk by the Realtors who want to sell your home for a big fat check? Is the risk real for being a DIY seller or is this just a scare tactic? Lets see how selling your home using an app differs from using the traditional Realtor.

Selling Your Home Using an App

Here is a common scenario that I hear regarding DIY sellers. A seller built an “add-on” (office, bedroom, expanded the kitchen..etc) onto their home. However, he/she failed to realize that if the “add-on” was not signed-off/approved by the the city then he/she can not use the extra square footage in the description or calculation size of the home. The seller then cannot advertise the “add-on” even if it is used as an extra: bedroom, office etc. The seller must treat the “add-on” like it does not exist. The seller being unaware of this law; closes escrow. After a year or so, the buyer realizes the sellers mistake.

The buyer takes the seller to court. The seller has to reimburse the buyer because he/she did not disclose that the “add-on” was not city approved and calculated it into the home size. In Orange County where most the cities average price per square foot is over $400, just a 500SQFT “add-on” reimbursement judgment would be $200,000. That is quite a big chunk of change and that is for just a small/minor “add-on”. Now lets say the seller had the city approve the “add-on” thus can include this room in the size and marketing. However, they must disclose that the room(s) was an “add-on” and produce all permits and city approvals. A lot of DIY sellers don’t realize they need to do this. Not because they don’t have these documentations, but because they simply didn’t know what their responsibilities were. Same outcome, buyer finds out a few years later and takes the seller to court.

This is just one example of countless things that could go wrong. There are hundreds of disclosure laws a seller must know if he/she decides to sell a home through an app. It’s really hard to know what the responsibility is as a DIY seller and we know that winging it only works out about 13% of the time.

The Solution for DIY Sellers

After DIY sellers started hearing all the nightmare stories they wanted a work around; cut out the agent by the utilization of technology and limit their liability. It’s the best of both worlds.

The solution? Hire a lawyer to work on only the paperwork/contract parts of the transaction after an offer comes in. Seems like a good idea, right? Well anyone who has dealt with lawyers know that it’s at least a $5,000 upfront retainer and around $500 an hour for a decent lawyer. In escrow there are literally thousands of pages of legal documents which need to be read over and then signed. How much time do you think it would take a lawyer to read a 1000 pages of legal documents and dissect each and every sentence at $500 an hour? This is a lawyers dream.

Now wait, it gets even better. If the deal falls apart midway through an escrow (which is extremely common as a buyer can back out for practically any reason within 17 days after a seller acceptance to get their full security deposit back) the seller still has to pay the lawyer for their time – unlike a Realtor. Usually, when a seller is selling their current home they need a new home to go to after their current home sells. This is called “purchasing a replacement property” or a “1031 exchange”.

The lawyer will also be charging to look over that transaction. Two transactions at once at $500 an hour. If one of these two transactions falls apart; they both fall apart. If this happens the DIY seller has to start the process all over again. Therefore, when a new offer comes in on their home it’s another $5,000 retainer and $500 an hour. A lot of money out of pocket and it starts to get quite expensive very quickly with no assurance their home is going to close escrow. If the DIY seller for whatever reason can not (or decides not to) sell their home, then that seller is out all those lawyer fees.

The Standard Realtor Selling Your Home

The benefit of hiring a realtor is they free up a tremendous amount of time and work for the seller. The seller also knows from the beginning what their cost of sale is going to be when the transaction closes. They know their fees upfront unlike the lawyer option. Now a Realtor will: market the home, walk the seller through all the legal documents and protect them from all the pitfalls and confusing verbiage, assume risk, negotiate the deal the seller wants, and the best part of all – the seller only has to pay this person if the home sells and closes escrow for the price they agree to sell it for. If they don’t sell the home for what the seller wanted to sell it for, then they pay nothing and walk away with absolutely no loss.

On the other hand the Realtor walks away with at least 6 months of time loss and thousands of dollars in marketing down the drain. Who’s really getting the bad deal here and and why on earth would we buy/sell homes through an app? It looks to me that using a realtor is the greatest deal in the world! The seller has no risk, and reaps all the rewards with legal protection.

Conclusion

In conclusion, as you can see based on the scenarios above, the Realtor deal is actually not a bad one and it is baffling to me how Realtors get a bad wrap. Selling or buying a home through an app is not only risky but just plane dumb. Hiring a lawyer is tremendously expensive with a lot of upfront costs and you have to still pay them for their time even if the transaction doesn’t go through. If you decide to skip the lawyer option you only have a 13% success rate of no litigation after the close.

Some people will still use the app to sell their home I’m sure. I mean, people use DIY apps to file their taxes to the IRS instead of using a true tax code professional – yikes! But in the end, Turbo Tax did not eliminate the tax accountants; just the bad ones.